July’s consumer price index (CPI) report received a warm reception from equity investors and Fed watchers. Inflation had fallen to its lowest level since 2021 (2.9% year-over-year), essentially paving the way for the first rate cut in years. Like clockwork, the chatter among investors was not if the Fed would cut rates at the September meeting, but by how much.

The ensuing 25-basis point vs. 50-basis point debate harkens back to 2023 and early 2024 when futures markets were forecasting six or more rate cuts for 2024, which was at the time double the Fed’s projection. Just about everyone was wrong. As it turned out, the stock market and the U.S. economy did not need lower interest rates to perform well. While the Fed funds rate has remained over 5% for the past year, GDP growth and market returns have been solidly positive.1

Nevertheless, with the Fed poised to cut interest rates at the September meeting, investors are once again being drawn into the narrative that lower rates are essential to stave off a recession and to keep the bull market going.

I still don’t buy that argument.

If we look at every bull market from 1950 onward, it’s easy to find several instances when interest rates were rising, the economy was expanding, and the stock market was going up—all at the same time. It happened in every bull market between 1950 and 1980, and notably from 2004 to 2006 and again from 2015 to 2019.

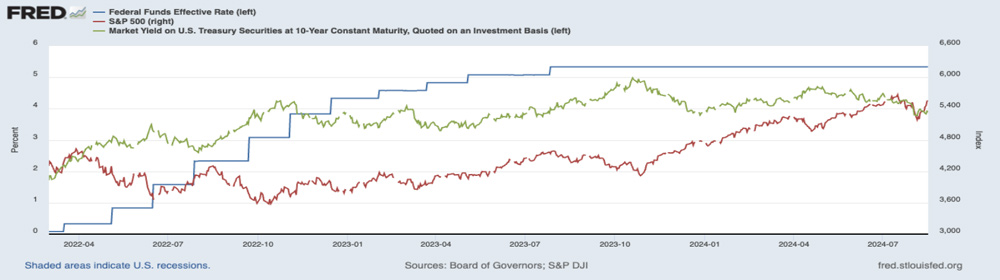

But you don’t need to be a market historian to find a time when rising interest rates aligned with rising stocks. It happened just over a year ago. In the chart below, readers can see the Fed funds rate (blue line), the 10-year U.S. Treasury bond yield (green line), and the S&P 500 index (red line) from March 2022 to August 16, 2024. In this period, interest rates have climbed, and so have stocks.

Source: Federal Reserve Bank of St. Louis2

To be more specific, from March 2022 to August 2024, this is what we’ve seen:

- Benchmark Fed Funds Rate: went from 0% to 5.25% – 5.5%

- 10-year U.S. Treasury Bond: went from 1.75% to 3.9%

- S&P 500 Index: went from 4,385 to 5,550 (up over +25%)

The idea that the U.S. economy and the stock market’s fate are in the Federal Reserve’s hands is simply not substantiated by what we know from history, or even from 2024. Interest rates have remained ‘higher-for-longer’ all year, and stocks have powered higher.

Monetary policy decisions are not meaningless, of course, but my argument here is that they are not as important as many investors think them to be.

In my view, what would hurt markets most is if inflation and inflation expectations start to drift higher and become un-anchored from their current 2.5% to 3.5% level, perhaps because of some unforeseen shock in geopolitics or the global economy. If the Fed is forced to go in the other direction—raising rates instead of cutting them because of a negative inflation surprise—I think that could be very detrimental to stocks. For now, however, inflation data continues to show the opposite, with gradually falling prices alongside signs of weakening in the jobs market—neither of which calls for higher rates.

Bottom Line for Investors

We know in the current environment that the Fed believes monetary policy is sufficiently restrictive, and with improving inflation readings and the unemployment rate rising from 3.7% at the beginning of the year to 4.3% in July, there is no expectation that interest rates will go any higher.

It’s also true that markets move on surprises, so if the Federal Reserve ended their September meeting with no rate cuts and a hawkish overall tone, I’d expect a volatile response from the stock market. But if the concern is whether the Fed will cut rates by 25 basis points or 50, and/or whether they will offer guidance for future rate cuts in November and December, I do not believe these are the outcomes influencing stocks most. Investors can frame market outlook in terms of shifting expectations around interest rates, but doing so means ignoring

Sources:

- MSN. 2024. https://advisor.zacksim.com/e/376582/nty-on-economy-fed-ar-AA1oR5UK/5rnv64/1004854014/h/ULpPPkTMOl6paVv1MMHY1qrsZfbyRpsK4lxorOHkkKE

- Fred Economic Data. August 19, 2024. https://advisor.zacksim.com/e/376582/series-DFF-/5rnv67/1004854014/h/ULpPPkTMOl6paVv1MMHY1qrsZfbyRpsK4lxorOHkkKE

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

The Russell 1000 Growth Index is a well-known, unmanaged index of the prices of 1000 large-company growth common stocks selected by Russell. The Russell 1000 Growth Index assumes reinvestment of dividends but does not reflect advisory fees. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

Nasdaq Composite Index is the market capitalization-weighted index of over 3,300 common equities listed on the Nasdaq stock exchange. The types of securities in the index include American depositary receipts, common stocks, real estate investment trusts (REITs) and tracking stocks, as well as limited partnership interests. The index includes all Nasdaq-listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds (ETFs) or debenture securities. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The Dow Jones Industrial Average measures the daily stock market movements of 30 U.S. publicly-traded companies listed on the NASDAQ or the New York Stock Exchange (NYSE). The 30 publicly-owned companies are considered leaders in the United States economy. An investor cannot directly invest in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The Bloomberg Global Aggregate Index is a flagship measure of global investment grade debt from twenty-four local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The ICE Exchange-Listed Fixed & Adjustable Rate Preferred Securities Index is a modified market capitalization weighted index composed of preferred stock and securities that are functionally equivalent to preferred stock including, but not limited to, depositary preferred securities, perpetual subordinated debt and certain securities issued by banks and other financial institutions that are eligible for capital treatment with respect to such instruments akin to that received for issuance of straight preferred stock. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The MSCI ACWI ex U.S. Index captures large and mid-cap representation across 22 of 23 Developed Markets (DM) countries (excluding the United States) and 24 Emerging Markets (EM) countries. The index covers approximately 85% of the global equity opportunity set outside the U.S. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The Russell 2000 Index is a well-known, unmanaged index of the prices of 2000 small-cap company common stocks, selected by Russell. The Russell 2000 Index assumes reinvestment of dividends but does not reflect advisory fees. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The S&P Mid Cap 400 provides investors with a benchmark for mid-sized companies. The index, which is distinct from the large-cap S&P 500, is designed to measure the performance of 400 mid-sized companies, reflecting the distinctive risk and return characteristics of this market segment.

The S&P 500 Pure Value index is a style-concentrated index designed to track the performance of stocks that exhibit the strongest value characteristics by using a style-attractiveness-weighting scheme. An investor cannot directly invest in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.