The Bond Markets Make a Tariff Statement

Given the flurry of tariff announcements (which are still ongoing) and elevated equity market volatility, investors may have understandably taken their eye off the U.S. bond markets. But there’s been action in U.S. Treasurys that is worth a closer look.

In the immediate days following President Trump’s April 2nd “Liberation Day” tariff announcement, Treasury bonds behaved as we’d expect them to. As stocks sold off sharply, investors poured into “risk-free” Treasury bonds, which sent bond prices higher and yields lower.1

But then something interesting happened.

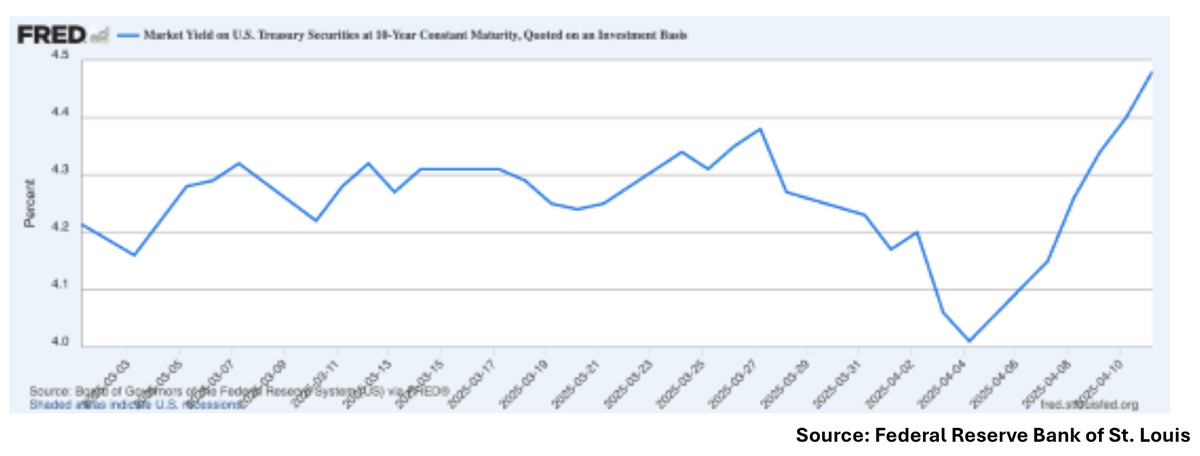

Starting on April 4th, Treasury bonds endured sustained selling pressure (with prices falling and yields rising) as stocks also fell, which added another layer of confusion to an already uncertain market environment. Given the U.S. Treasurys’ status as the world’s safe-haven asset during periods of global economic and market upheaval, one would have expected bond prices to rise as stocks fell. But the opposite started occurring. Investors were dumping Treasurys and stocks at the same time, with the 10-year Treasury yield notably jumping from 4.20% to over 4.50% within a four-day stretch. That marked its steepest increase since the 2008 financial crisis.

10-Year U.S. Treasury Bond Yields Spiked in the Wake of “Liberation Day”

One possible explanation for the sharp move in Treasury yields is rising inflation expectations. Treasurys are caught in a tug-of-war between growing recession fears (which would send yields lower) and the possibility of higher inflation due to tariffs (which would send yields higher). Perhaps inflation concerns were winning the day.

Another explanation is more technical. Institutional investors unwound complex leveraged trades en masse, such as basis trades, which rely on small price discrepancies between Treasury instruments. As yields spiked, these trades became unprofitable, forcing hedge funds to liquidate positions rapidly—which intensified the upside volatility.

The U.S. dollar also deserves a mention here. The dollar has long been the dominant reserve currency worldwide. The greenback is widely used by governments and institutions to stabilize their own currencies, manage trade flows, service debt, and prepare for unexpected economic shocks. And because global commerce is so often conducted in dollars, there’s a persistent demand to hold them—typically parked in U.S. Treasurys. In this sense, ongoing demand for U.S. dollars and Treasurys keeps yields in check.

There’s an argument that evolving trade dynamics are prompting some investors to re-evaluate the dollar’s centrality in global transactions. Central banks and sovereign investors aren’t pulling back per se, but they appear slightly more cautious when it comes to increasing their U.S. Treasury holdings. This could put upward pressure on yields over time.

Whatever the ultimate reason for the surge in 10-year Treasury bond yields, the message was clear: financial markets were not responding well to the proposed global order on trade.

Then came the 90-day pause, after which the stock market delivered one of its largest single-day rallies in history. In hitting the pause button, the worst-case scenario was taken off the table, and stocks surged. As I wrote in a Mitch on the Markets column two weeks ago, “[good news] will almost certainly trigger strong moves higher, [and] long-term investors simply cannot afford to miss these upswings.”

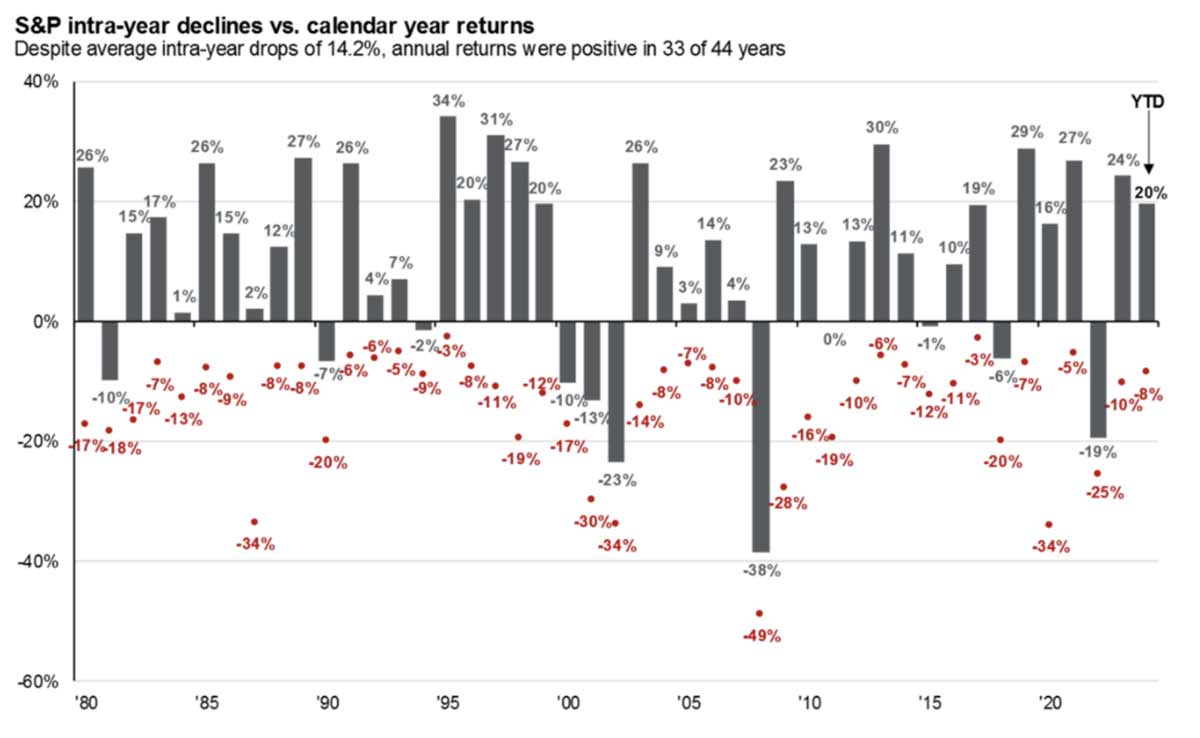

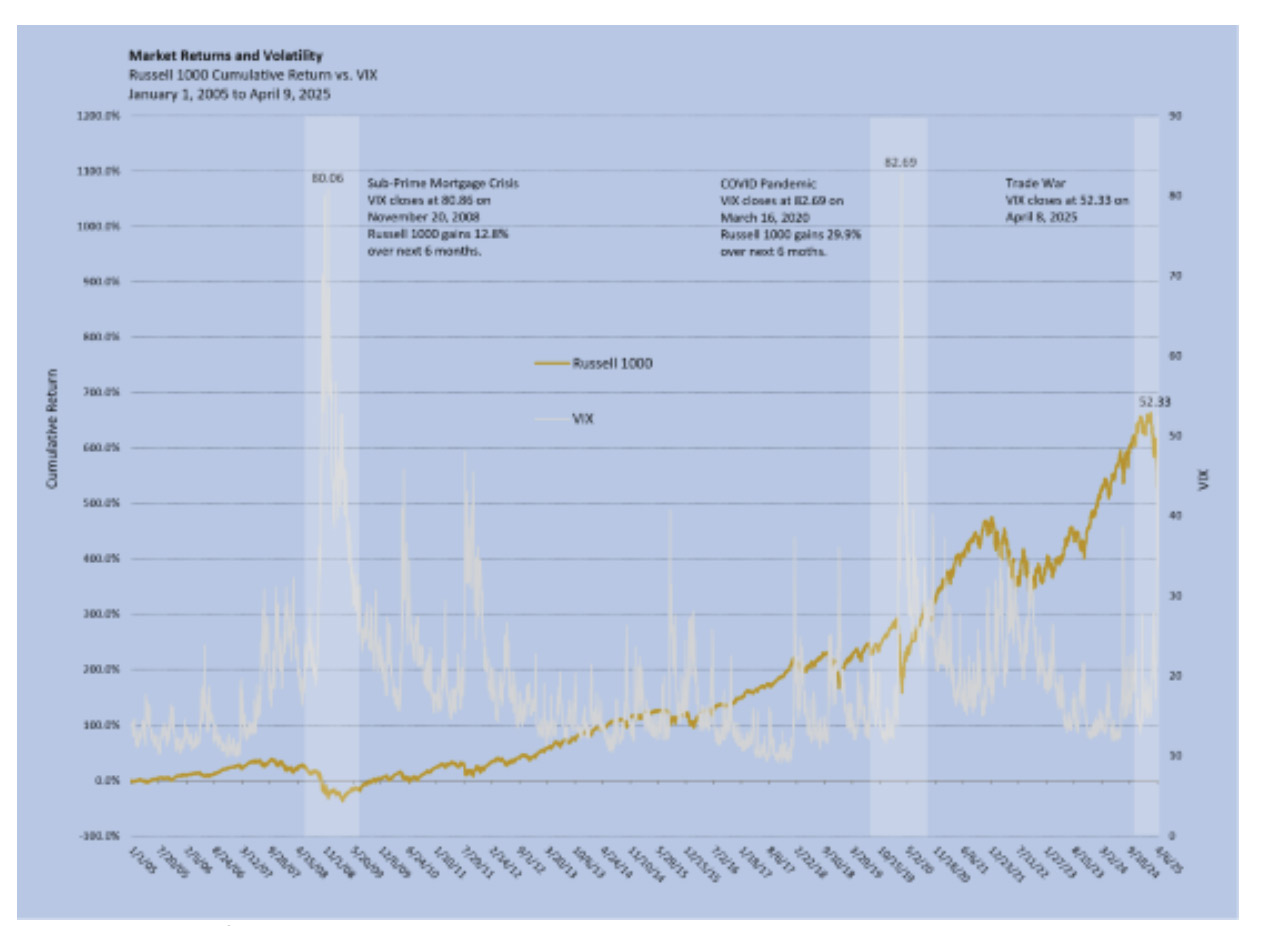

This brings me to a final point I’d like to make about market volatility, which is a point I’ve made many times before: remember that volatility works both ways. The very best days in the stock market often occur in close proximity to the worst days, often by less than a week. It’s basically impossible, in my view, to time the market so you only participate in the up days but avoid the down days.

The chart below zooms out and looks at the relationship between a surge in volatility and forward market returns. As readers can see, the previous instances when volatility reached extremes occurred in 2008 and in 2020. In both instances, stocks (as measured by the Russell 1000 Index) posted double-digit gains in the following six months.

Bottom Line for Investors

The recent spike in Treasury yields and unusual cross-asset selling are signs that markets are grappling with a complex mix of policy uncertainty, shifting inflation expectations, and evolving global trade dynamics. Investors should expect heightened volatility to continue in the near term, as trade policy is negotiated and news updates hit the tape.

But it’s important to remember that volatility—especially in response to political or policy-driven events—works both ways, and we have already seen how major moves in the market can prompt the administration to step-in with actions to de-escalate. There is still plenty left to learn on tariff and trade policy—but at least for now, the direction of travel appears to be away from the most punitive starting point.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

The Russell 1000 Growth Index is a well-known, unmanaged index of the prices of 1000 large-company growth common stocks selected by Russell. The Russell 1000 Growth Index assumes reinvestment of dividends but does not reflect advisory fees. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

Nasdaq Composite Index is the market capitalization-weighted index of over 3,300 common equities listed on the Nasdaq stock exchange. The types of securities in the index include American depositary receipts, common stocks, real estate investment trusts (REITs) and tracking stocks, as well as limited partnership interests. The index includes all Nasdaq-listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds (ETFs) or debenture securities. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The Dow Jones Industrial Average measures the daily stock market movements of 30 U.S. publicly-traded companies listed on the NASDAQ or the New York Stock Exchange (NYSE). The 30 publicly-owned companies are considered leaders in the United States economy. An investor cannot directly invest in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The Bloomberg Global Aggregate Index is a flagship measure of global investment grade debt from twenty-four local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The ICE Exchange-Listed Fixed & Adjustable Rate Preferred Securities Index is a modified market capitalization weighted index composed of preferred stock and securities that are functionally equivalent to preferred stock including, but not limited to, depositary preferred securities, perpetual subordinated debt and certain securities issued by banks and other financial institutions that are eligible for capital treatment with respect to such instruments akin to that received for issuance of straight preferred stock. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The MSCI ACWI ex U.S. Index captures large and mid-cap representation across 22 of 23 Developed Markets (DM) countries (excluding the United States) and 24 Emerging Markets (EM) countries. The index covers approximately 85% of the global equity opportunity set outside the U.S. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The Russell 2000 Index is a well-known, unmanaged index of the prices of 2000 small-cap company common stocks, selected by Russell. The Russell 2000 Index assumes reinvestment of dividends but does not reflect advisory fees. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The S&P Mid Cap 400 provides investors with a benchmark for mid-sized companies. The index, which is distinct from the large-cap S&P 500, is designed to measure the performance of 400 mid-sized companies, reflecting the distinctive risk and return characteristics of this market segment.

The S&P 500 Pure Value index is a style-concentrated index designed to track the performance of stocks that exhibit the strongest value characteristics by using a style-attractiveness-weighting scheme. An investor cannot directly invest in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.