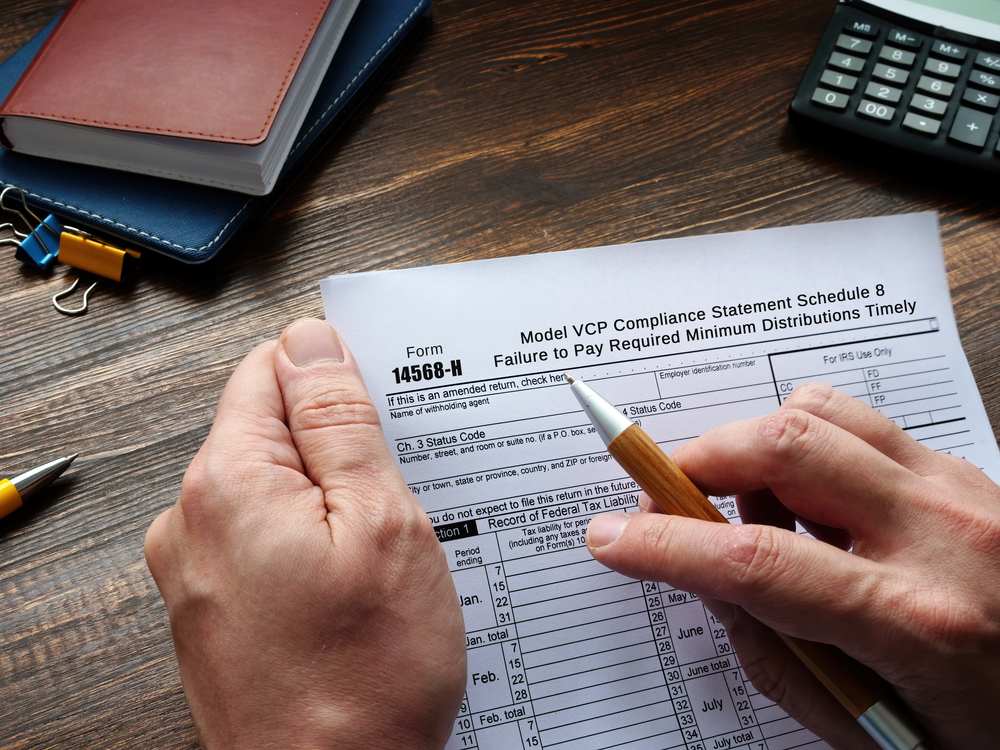

Required minimum distributions (RMDs) are not well understood, and we would like to clear up some confusion about them. First of all, they cannot be automated, so you are responsible for remembering that they must be taken, by their due dates and in the right amounts from the right accounts. Of course, feel free to reach out to us for more information about your personal situation. We are here to help!

The Basics About RMDs

1) RMDs are not automatic, and not all institutions or custodians provide reminders. Retirees must proactively remember to take RMDs.

2) You must take RMDs from all your traditional (non-Roth) qualified accounts annually, including IRAs, 401(k) plans, 403(b) plans, 457(b) plans, TSPs, SEP IRAs, SIMPLE IRAs and similar types of accounts.

3) The deadline for RMDs is December 31 each year, not April 15. Missing the deadline can come with a 25% excise penalty along with income taxes owed.

4) For clients taking their very first RMD, the distribution must be taken by April 1 of the year following the calendar year in which they reach age 73.

5) Required minimum distributions are subject to ordinary income taxes and are added to your combined income (sometimes called provisional income) for Social Security tax purposes.

6) The first dollars you withdraw from taxable retirement accounts in any given year are considered RMDs. This is important to remember if you decide to do Roth conversions.

7) Depending on type, there are different rules regarding taking a percentage of the aggregated amount held in multiple qualified accounts, versus requiring separate withdrawals from each different account. For instance:

a) You can generally aggregate your traditional (non-Roth) IRA account amounts and withdraw the total amount due from one of your IRAs.

b) For 401(k) and 457(b) accounts, you must calculate and withdraw RMD money separately from each individual account that you own. (This is why some retirees choose to roll over accounts for simplicity.)

c) For 403(b) plans, you can aggregate amounts in all your 403(b)s, but you can’t aggregate those amounts with other types of accounts that you own, such as IRAs or 401(k)s.

d) Spouses cannot aggregate their accounts. Each spouse must take RMDs separately from their own accounts.

e) For inherited IRAs, RMDs can only be aggregated with other inherited IRAs if they were inherited from the same original owner.

8) Miscalculated amounts, late RMDs, or withdrawals taken from the wrong accounts often come with a 25% excise tax on top of income taxes owed.

9) The SECURE Act, which took effect January 1, 2020, changed RMD rules significantly, and many people who inherit taxable qualified accounts are still unaware of how this affects them. Non-spousal heirs must take RMDs, and empty inherited accounts completely within 10 years of inheritance. Surviving spouses must take RMDs, too. The IRS uses several tables to calculate RMD amounts owed.

10) If you give to charity, you can often directly distribute all or part of your RMD to your chosen nonprofit, reducing your taxable income by that amount. These are called qualified charitable distributions (QCDs). But there is a caveat. Some financial institutions don’t break down or delineate that your distribution was a charitable contribution—they just send you a 1099. It is critical for you to make sure these amounts are deducted rather than added to your tax return!

A recent breakdown of the most common (and surprising!) RMD mistakes revealed just how easy it is for retirees to make costly errors. We can partner with your tax advisors to make a plan for your future RMDs, potentially finding ways to mitigate your tax burden. Give us a call today and understand your options before you need them! You can reach BayTrust Financial in Tampa at 813.820.0069.

This article is for general information purposes only from sources believed to be accurate. It should not be construed as tax advice. In every case, you should consult with your own personal team of tax, financial, and legal advisors for tax advice specific to your own personal financial situation.

Sources:

https://www.financialadvisoriq.com/c/4991394/692364/affluent_investors_want_planning_cerulli

https://insights.smartasset.com/7-of-the-biggest-rmd-mistakes-people-make

https://www.thinkadvisor.com/2025/09/23/the-worst-rmd-mistakes-clients-made-advisors-advice/