Mitch Zacks – Weekly Market Commentary: How the One Big Beautiful Bill Act (OBBBA) Affects Investors

Digging into the One Big Beautiful Bill Act

The One Big Beautiful Bill Act (OBBBA) has been signed into law, which makes now a good time to review how the law financially affects individuals, families, and businesses. Depending on where you look, you can find sweeping praise or stern criticism of the law’s provisions. I’ll offer no such viewpoint here.1

My goal instead is to give readers straightforward, objective commentary on how the bill impacts household and corporate finances, which by extension can provide clues regarding potential investment implications.

I’d like to start with what has not changed. Despite some speculation during the legislative process, the OBBBA doesn’t raise corporate tax rates or alter capital gains tax rates. There is also no “millionaire’s surcharge,” no wealth tax, and no financial transaction tax, proposals that circulated in early drafts but didn’t make it into the final version. For many investors and business owners, the absence of these changes means that planning strategies from recent years remain intact.

Now let’s jump into what the law means for individuals, families, and businesses.

Key Provisions for Individuals and Families:

A major feature of the OBBBA is that it makes the 2017 Tax Cuts and Jobs Act individual tax rates permanent. This includes:

- Lower marginal tax brackets

- The expanded standard deduction was locked in, and will now be adjusted for inflation starting in 2026. In that year, the standard deduction for single filers will rise to $16,550, while married couples filing jointly will be able to deduct $33,100. For 2025, single filers will see a temporary $1,000 increase in the standard deduction while joint filers will receive $2,000.

- The repeal of personal exemptions

- Higher thresholds for the alternative minimum tax (AMT)

- For individuals who own small businesses, OBBBA also made permanent the 20% deduction for qualified business income (QBI) from pass-through entities like S corps and partnerships.

Several new deductions were also added, but many come with income phaseouts or sunset provisions. Here are the key deductions I think will impact most readers:

- The state and local tax (SALT) deduction cap rises from $10,000 to $40,000 from 2025 to 2029, but it phases out above $500,000 of modified adjusted gross income (MAGI) and reverts to $10,000 in 2030.

- A new $6,000 per-person deduction for seniors (age 65+) begins in 2025 and runs through 2028. It begins to phase out at $75,000 of income for singles and $150,000 for married couples.

- A deduction of up to $25,000 for tips and $12,500 for overtime pay is available—but again, both are subject to income phaseouts and expire in 2028.

These new deduction provisions offer targeted relief and are allowed even if the standard deduction is taken, which helps widen their reach. However, they do not reduce adjusted gross income (AGI), meaning they won’t lower exposure to the 3.8% net investment income tax or Medicare IRMAA surcharges.

Key Provisions for Businesses

OBBBA reinstates and makes permanent 100% bonus depreciation for qualified property placed in service after January 19, 2025. It also adds a new category, Qualified Production Property, for U.S.-based manufacturers and refiners. Importantly, both bonus depreciation and the expanded standard deduction will now be adjusted for inflation starting in 2026, offering longer-term planning consistency for businesses.

Other key changes for business owners include:

- Increased Section 179 expensing limits (now $2.5 million), which allows businesses to write off the full cost of eligible assets in the year they’re placed in service, rather than depreciating them over time. For business owners making large capital investments—this can deliver meaningful tax savings and improve after-tax cash flow in the near term. In other words, good for earnings.

- Retroactive R&D expensing for 2022 and 2023

- More lenient business interest deductibility under Section 163(j), which effectively raises the ceiling on deductible interest expense, especially for capital-intensive industries. Companies that invest heavily in equipment, facilities, or R&D often have large depreciation expenses. Excluding those from the interest deduction formula means more of their borrowing costs can be written off, making financing growth more attractive.

Bottom Line for Investors

There’s a lot to unpack here, and I did not broach the issue of deficits and the trajectory of U.S. debt, both of which could impact interest rates over time. That said, many of the new provisions expire before the end of the decade, and future Congresses will almost certainly debate the economic and fiscal impact in future years.

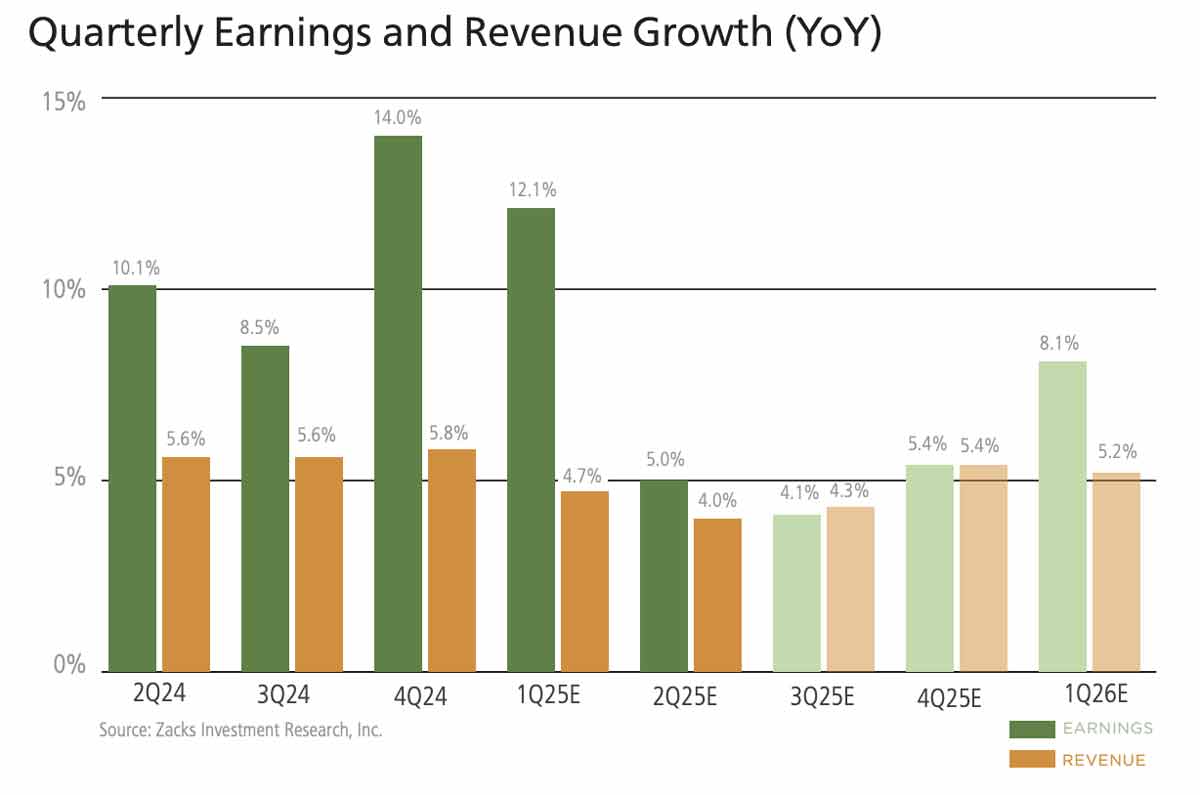

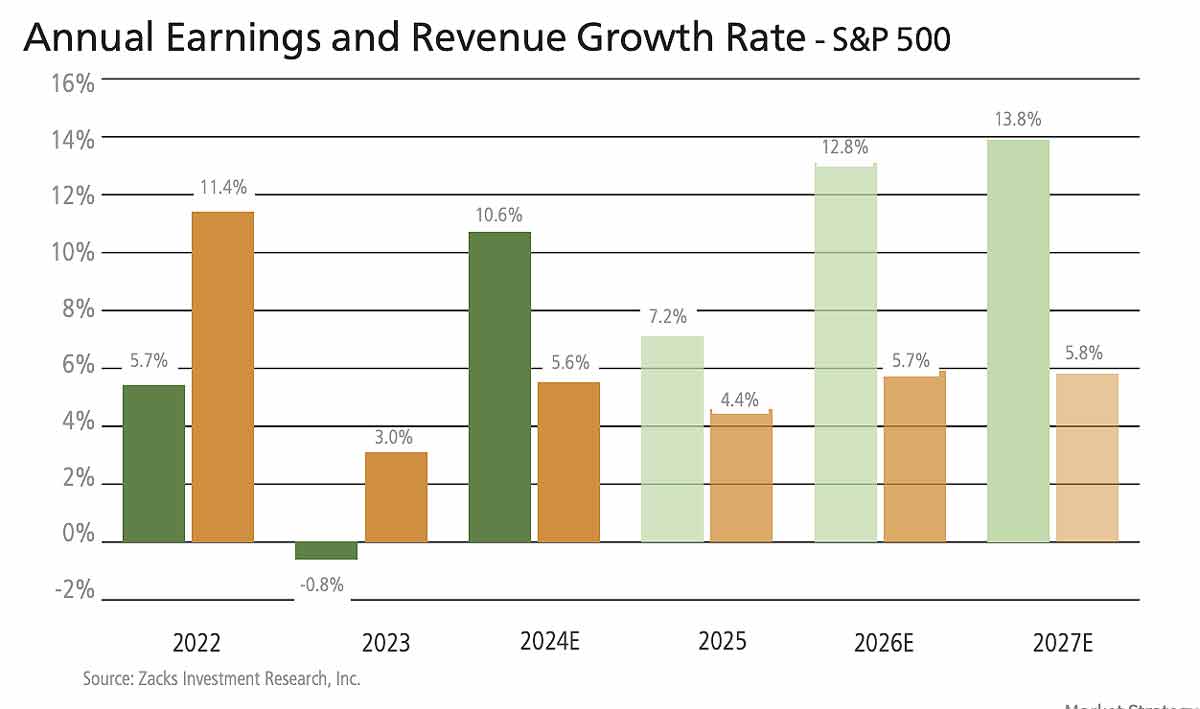

In the meantime, investors should view this through the lens of being substantial fiscal stimulus, which also comes as the Federal Reserve appears poised to ease monetary policy to bring the benchmark fed funds rate back to the neutral level. When you have fiscal stimulus and monetary stimulus in the same year, it’s difficult to make a case against owning equities.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

The Russell 1000 Growth Index is a well-known, unmanaged index of the prices of 1000 large-company growth common stocks selected by Russell. The Russell 1000 Growth Index assumes reinvestment of dividends but does not reflect advisory fees. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

Nasdaq Composite Index is the market capitalization-weighted index of over 3,300 common equities listed on the Nasdaq stock exchange. The types of securities in the index include American depositary receipts, common stocks, real estate investment trusts (REITs) and tracking stocks, as well as limited partnership interests. The index includes all Nasdaq-listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds (ETFs) or debenture securities. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The Dow Jones Industrial Average measures the daily stock market movements of 30 U.S. publicly-traded companies listed on the NASDAQ or the New York Stock Exchange (NYSE). The 30 publicly-owned companies are considered leaders in the United States economy. An investor cannot directly invest in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The Bloomberg Global Aggregate Index is a flagship measure of global investment grade debt from twenty-four local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The ICE Exchange-Listed Fixed & Adjustable Rate Preferred Securities Index is a modified market capitalization weighted index composed of preferred stock and securities that are functionally equivalent to preferred stock including, but not limited to, depositary preferred securities, perpetual subordinated debt and certain securities issued by banks and other financial institutions that are eligible for capital treatment with respect to such instruments akin to that received for issuance of straight preferred stock. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The MSCI ACWI ex U.S. Index captures large and mid-cap representation across 22 of 23 Developed Markets (DM) countries (excluding the United States) and 24 Emerging Markets (EM) countries. The index covers approximately 85% of the global equity opportunity set outside the U.S. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The Russell 2000 Index is a well-known, unmanaged index of the prices of 2000 small-cap company common stocks, selected by Russell. The Russell 2000 Index assumes reinvestment of dividends but does not reflect advisory fees. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The S&P Mid Cap 400 provides investors with a benchmark for mid-sized companies. The index, which is distinct from the large-cap S&P 500, is designed to measure the performance of 400 mid-sized companies, reflecting the distinctive risk and return characteristics of this market segment.

The S&P 500 Pure Value index is a style-concentrated index designed to track the performance of stocks that exhibit the strongest value characteristics by using a style-attractiveness-weighting scheme. An investor cannot directly invest in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.