Why Markets Rarely Flinch at Government Shutdowns

As readers are well aware, the U.S. government officially shut down after lawmakers failed to reach a funding deal. To date, paychecks for hundreds of thousands of federal employees have been paused, and some national parks and agencies have been shuttered, including the Bureau of Labor Statistics, which supplies jobs and inflation data.

Government shutdowns almost always get constant media attention, perhaps understandably so. They are disruptive and create plenty of short-term uncertainty.1

But for investors, they need not be a source of stress or urgent concern. History tells us, quite clearly, that shutdowns have not been a source of meaningful and certainly not lasting economic impact.

Since 1976, there have been more than 20 shutdowns of varying lengths. None has caused a recession. None has triggered a bear market. And in many cases, stocks moved higher during the shutdown and in the months immediately after. The longest shutdown on record, 35 days spanning late 2018 into early 2019, coincided with a strong equity rally.

If we parse out the data even more, going back to all shutdowns since 1976, we find that the S&P 500 was up an average of 12.1% in the year following a shutdown. In the second longest shutdown (21 days in late 1995 and early 1996), stocks went up 3.1% in the month after the shutdown, and +21.3% in the following year.

This is not to say shutdowns come without consequences and should be completely ignored. Hundreds of thousands of federal employees are furloughed without pay, while others, such as members of the military and air traffic controllers, continue working but receive their paychecks later. Businesses that depend on government contracts can see delays, and data collection also halts—which means key economic reports, including the monthly jobs and inflation data, are delayed. In an environment where the Federal Reserve is highly data-dependent, that could momentarily complicate monetary policy decisions.

Still, the broader economic footprint of a shutdown is surprisingly small. Most of the federal budget keeps flowing even when Washington hits a stalemate. Social Security, Medicare, and interest payments on U.S. debt continue, covering roughly three-quarters of total federal outlays. Mandatory programs don’t shut down. And when the government reopens, furloughed workers are paid retroactively, meaning much of the lost income and spending returns to the economy in short order.

For investors, that’s an important distinction. Shutdowns are inherently temporary, and markets know it. A federal funding impasse has yet to alter corporate earnings trends, long-term inflation trajectories, or consumer behavior in any meaningful way. In fact, markets often rise during shutdowns precisely because investors have seen this story before and know how it ends. The government eventually reopens, paychecks resume, and the economic data catch up.

Some commentators have worried about the potential for a shutdown to weigh on consumer confidence or market sentiment. That’s possible in the short term, especially if the headlines grow louder and political rhetoric intensifies. But even in those cases, the effect tends to fade quickly. The same pattern has repeated across decades, with temporary volatility followed by quick stabilization as markets refocus on fundamentals.

Bottom Line for Investors

The question for investors, then, is: are the economic fundamentals still strong enough for markets to look through the shutdown?

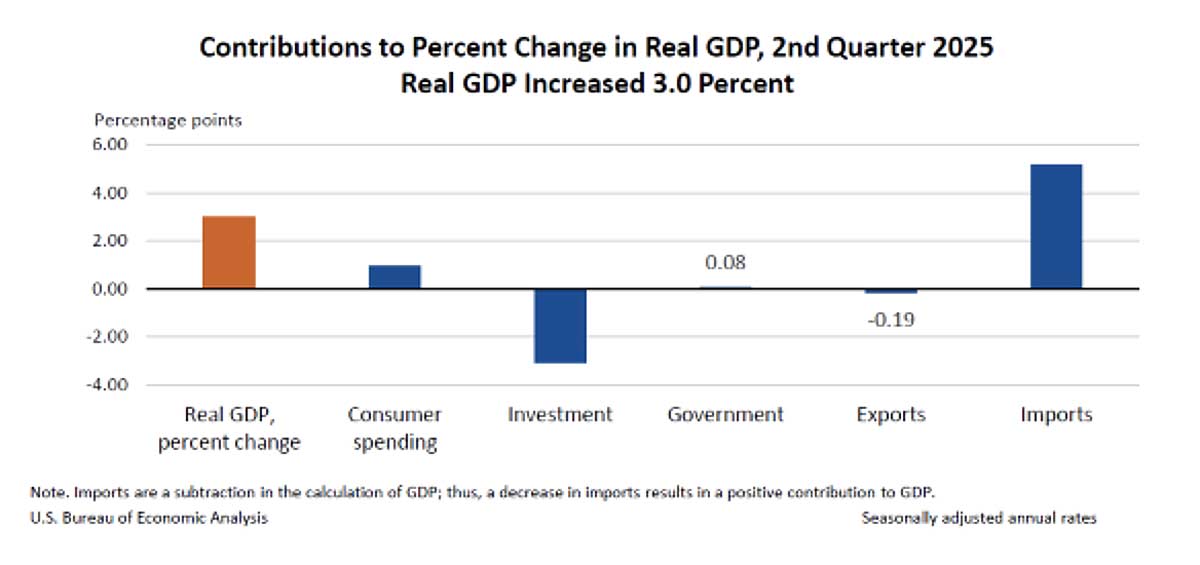

In my view, the answer is yes. Growth has moderated from last year’s pace, but the economy continues to expand. The jobs market is showing signs of leveling off, but unemployment remains low. Business investment remains solid, thanks in large part to AI investment, and corporate profits are holding up well. Our colleagues at Zacks Investment Research have been noting for some time now that forward estimates continue to trend higher, signaling confidence in corporate America. The U.S. financial system also remains in fine shape, with healthy lending activity in a monetary easing cycle.

In this kind of environment, it takes more than a political impasse to derail the broader trend.

1 Wall Street Journal. October 1, 2025. https://advisor.zacksim.com/e/376582/-mod-economy-more-article-pos2/5tp38p/1340471816/h/oHCC4EptMjDjKBX9l32s0Ez55oiv-jRLalL68_h0dWM

2 Fred Economic Data. October 6, 2025. https://advisor.zacksim.com/e/376582/series-SP500-/5tp38s/1340471816/h/oHCC4EptMjDjKBX9l32s0Ez55oiv-jRLalL68_h0dWM

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

The Russell 1000 Growth Index is a well-known, unmanaged index of the prices of 1000 large-company growth common stocks selected by Russell. The Russell 1000 Growth Index assumes reinvestment of dividends but does not reflect advisory fees. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

Nasdaq Composite Index is the market capitalization-weighted index of over 3,300 common equities listed on the Nasdaq stock exchange. The types of securities in the index include American depositary receipts, common stocks, real estate investment trusts (REITs) and tracking stocks, as well as limited partnership interests. The index includes all Nasdaq-listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds (ETFs) or debenture securities. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The Dow Jones Industrial Average measures the daily stock market movements of 30 U.S. publicly-traded companies listed on the NASDAQ or the New York Stock Exchange (NYSE). The 30 publicly-owned companies are considered leaders in the United States economy. An investor cannot directly invest in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The Bloomberg Global Aggregate Index is a flagship measure of global investment grade debt from twenty-four local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The ICE Exchange-Listed Fixed & Adjustable Rate Preferred Securities Index is a modified market capitalization weighted index composed of preferred stock and securities that are functionally equivalent to preferred stock including, but not limited to, depositary preferred securities, perpetual subordinated debt and certain securities issued by banks and other financial institutions that are eligible for capital treatment with respect to such instruments akin to that received for issuance of straight preferred stock. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The MSCI ACWI ex U.S. Index captures large and mid-cap representation across 22 of 23 Developed Markets (DM) countries (excluding the United States) and 24 Emerging Markets (EM) countries. The index covers approximately 85% of the global equity opportunity set outside the U.S. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The Russell 2000 Index is a well-known, unmanaged index of the prices of 2000 small-cap company common stocks, selected by Russell. The Russell 2000 Index assumes reinvestment of dividends but does not reflect advisory fees. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The S&P Mid Cap 400 provides investors with a benchmark for mid-sized companies. The index, which is distinct from the large-cap S&P 500, is designed to measure the performance of 400 mid-sized companies, reflecting the distinctive risk and return characteristics of this market segment.

The S&P 500 Pure Value index is a style-concentrated index designed to track the performance of stocks that exhibit the strongest value characteristics by using a style-attractiveness-weighting scheme. An investor cannot directly invest in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.