There is little question about the impact the artificial intelligence boom is having on S&P 500 earnings and total return.1 According to my colleagues at Zacks Investment Research, the “Magnificent 7” group of mega-cap technology stocks is on track to bring in 26% of all S&P 500 earnings this year, up from 23.2% of the total in 2024 and 11.7% in 2019. The group also made up roughly 35% of the index as of the end of the third quarter.2

But what about the impact the AI spending boom is having on the U.S. economy?

In short, it’s been significant.

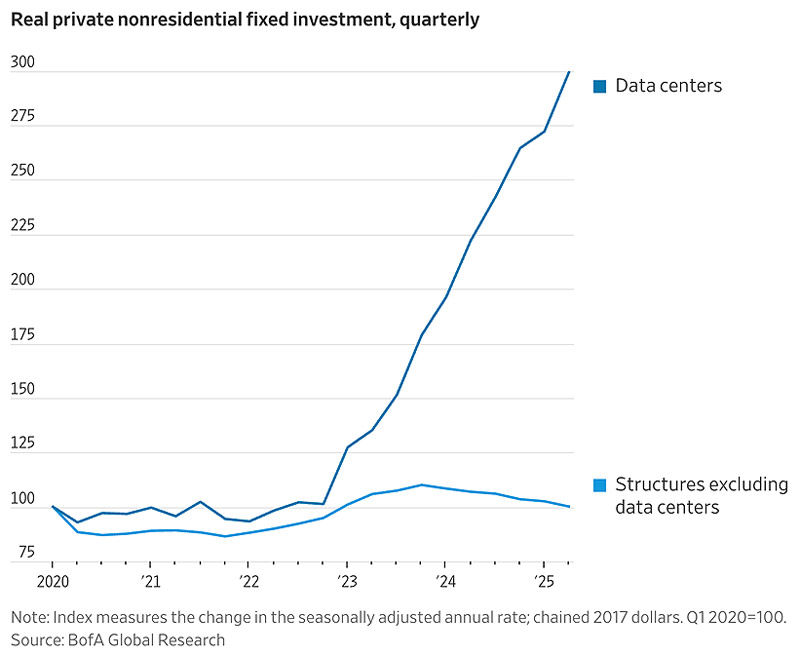

By some estimates, first-half 2025 GDP growth was substantially powered by spending on data centers, information-processing equipment, and software. Excluding these categories, economic growth would have been more modest. To grasp the scale of AI’s impact, consider that the dollar value of AI data-center investment has exceeded total consumer-spending contributions to GDP in 2025. The chart below also demonstrates data centers’ contribution to total fixed private investment. It’s pretty remarkable.

Wall Street Journal3

Without the lift from AI capex, economic growth may have been more modest, closer to 1.5% perhaps, in the first half. Growth is growth, but I think it’s a fair argument to frame the broader economy’s performance as more ‘steady’ than ‘booming.’ The impact of AI spending doesn’t dilute growth elsewhere, it just moves the needle in the booming direction.

Outside of the AI theme, investors can find soft patches in the economy. Retail sales in September (delayed due to the shutdown) rose just 0.2%, with noticeable pullbacks in tariff-sensitive categories such as vehicles, electronics, and clothing.4 Spending on services remained firm, however, which suggests consumers are still spending selectively and with more emphasis on value. It’s a pattern consistent with an expansion that continues, but with less broad-based momentum.

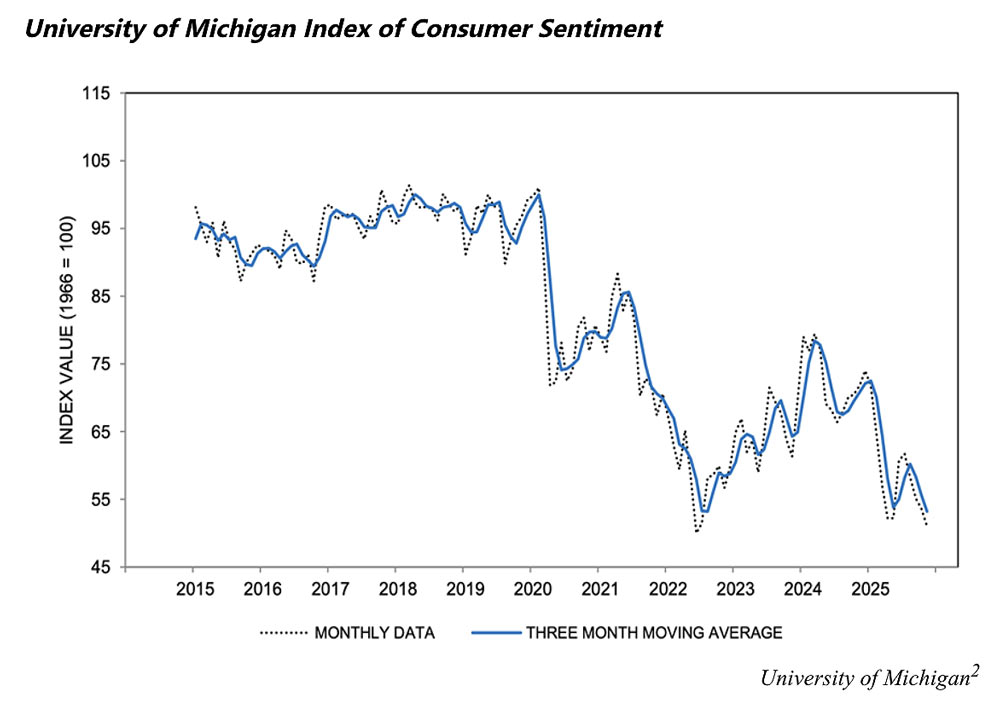

Sentiment surveys show similar nuance. The Conference Board’s confidence index fell in November to 88.7 from 95.5, while the share of households reporting plentiful job opportunities also stepped down. The University of Michigan’s survey has hovered near historical lows for months. As I wrote in a recent column, I think this is symptomatic of a “K-shaped” economy, which is relying more on high-income consumers and wealth effects than on job creation or broad wage gains. This is not a negative setup, it’s just a read on where the economy largely is today.

Does this all mean that a slowdown in AI spending would cause an economic downturn by itself? At this moment, I don’t think so. But I think it could meaningfully trim the growth rate, such that the U.S. economy would be posting more modest growth than the 2% to 3% headline rate that signals overall strength. This possibility does not suggest crouching in defensive mode and waiting for AI spending to pullback substantially—it argues for positioning in solid companies with earnings growth momentum outside of the AI trade.

Bottom Line for Investors

I think it’s clear that AI spending has provided a boost to headline GDP this year. When you strip out the sizable capex numbers, what you see is a modestly positive expansion versus a boom. I want to be clear—this is not a bad backdrop for long-term investors. But it does leave the cycle more sensitive to a potential shift from a single, powerful growth engine (AI capex).

I think that’s the real takeaway here. The economy is in fine shape, but it’s more dependent on one theme than usual. If AI investment keeps flowing, the expansion can keep chugging along. If it downshifts, the underlying modest growth pace may become more visible. Rather than trying to forecast when or if that happens, investors are better served maintaining balance across sectors, styles, and regions so portfolios aren’t tethered to any one story. If AI capex deflates, I could see assets rotating into under-valued areas of the market that are still seeing strong earnings growth.

1 Wall Street Journal. November 24, 2025. https://advisor.zacksim.com/e/376582/ng-4b6bc7ff-mod-article-inline/5twbjh/1402707083/h/Xd24NqpfuxBTxb20ypIcpZPxo_W4o4kOOMs0GnDkLxY

2 Zacks.com. November 22, 2025. https://advisor.zacksim.com/e/376582/outlook-improves-a-closer-look/5twbjl/1402707083/h/Xd24NqpfuxBTxb20ypIcpZPxo_W4o4kOOMs0GnDkLxY

3 Wall Street Journal. November 21, 2025. https://advisor.zacksim.com/e/376582/ng-4b6bc7ff-mod-article-inline/5twbjh/1402707083/h/Xd24NqpfuxBTxb20ypIcpZPxo_W4o4kOOMs0GnDkLxY

4 Wall Street Journal. November 25, 2025. https://advisor.zacksim.com/e/376582/ons-536756d2-mod-hp-lead-pos11/5twbjp/1402707083/h/Xd24NqpfuxBTxb20ypIcpZPxo_W4o4kOOMs0GnDkLxY

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

The Russell 1000 Growth Index is a well-known, unmanaged index of the prices of 1000 large-company growth common stocks selected by Russell. The Russell 1000 Growth Index assumes reinvestment of dividends but does not reflect advisory fees. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

Nasdaq Composite Index is the market capitalization-weighted index of over 3,300 common equities listed on the Nasdaq stock exchange. The types of securities in the index include American depositary receipts, common stocks, real estate investment trusts (REITs) and tracking stocks, as well as limited partnership interests. The index includes all Nasdaq-listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds (ETFs) or debenture securities. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The Dow Jones Industrial Average measures the daily stock market movements of 30 U.S. publicly-traded companies listed on the NASDAQ or the New York Stock Exchange (NYSE). The 30 publicly-owned companies are considered leaders in the United States economy. An investor cannot directly invest in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The Bloomberg Global Aggregate Index is a flagship measure of global investment grade debt from twenty-four local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The ICE Exchange-Listed Fixed & Adjustable Rate Preferred Securities Index is a modified market capitalization weighted index composed of preferred stock and securities that are functionally equivalent to preferred stock including, but not limited to, depositary preferred securities, perpetual subordinated debt and certain securities issued by banks and other financial institutions that are eligible for capital treatment with respect to such instruments akin to that received for issuance of straight preferred stock. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The MSCI ACWI ex U.S. Index captures large and mid-cap representation across 22 of 23 Developed Markets (DM) countries (excluding the United States) and 24 Emerging Markets (EM) countries. The index covers approximately 85% of the global equity opportunity set outside the U.S. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The Russell 2000 Index is a well-known, unmanaged index of the prices of 2000 small-cap company common stocks, selected by Russell. The Russell 2000 Index assumes reinvestment of dividends but does not reflect advisory fees. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The S&P Mid Cap 400 provides investors with a benchmark for mid-sized companies. The index, which is distinct from the large-cap S&P 500, is designed to measure the performance of 400 mid-sized companies, reflecting the distinctive risk and return characteristics of this market segment.

The S&P 500 Pure Value index is a style-concentrated index designed to track the performance of stocks that exhibit the strongest value characteristics by using a style-attractiveness-weighting scheme. An investor cannot directly invest in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.