As you near retirement you’re probably focused on making sure you have enough income to enjoy the years ahead. While enjoying what you’ve worked hard to build should be a priority, you should also keep in mind that withdrawing the money you’ve saved in traditional 401(k)s and IRAs can impact your Medicare costs throughout your retirement. Read on to see what having a high income could cost you in Medicare premiums and what strategies could potentially help you keep more money in your pocket and less going to Medicare premiums which are deducted from your Social Security check.

Understanding Medicare

First make sure you understand Medicare, how it’s broken up, and what plan you will likely choose. Medicare is sectioned into different parts, each serving a unique role in delivering health care coverage. These parts include Part A, Part B, Part D, and additional coverage options like Medicare Advantage (Part C) and Medigap.

- Part A (Hospital Insurance): Covers inpatient hospital stays, skilled nursing facility care, hospice care, and limited home health care. This is normally free for most people who have qualified for Medicare coverage.

- Part B (Medical Insurance): Covers doctor visits, outpatient care, home health care, and preventive services like screenings and wellness visits, along with durable medical equipment (e.g., wheelchairs). Part B coverage is the premium that will be deducted from your Social Security check if you don’t choose Medigap or Part C.

- Part D (Prescription Drug Coverage): Helps cover the cost of prescription medications, including certain vaccines. You can get Part D as a standalone plan along with Part B or as part of a Medicare Advantage Plan.

- Medicare Supplemental Insurance (Medigap): Extra coverage from private insurers to help pay for out-of-pocket costs in Original Medicare, such as copayments and coinsurance. Plans are standardized by letter (e.g., Plan G, Plan K).

- Part C (Medicare Advantage Plans): Private, Medicare-approved plans that may bundle Part A, Part B, and often Part D (prescription drug) coverages. Usually limited to providers within the plan’s network. May have different out-of-pocket costs and additional benefits not available in Original Medicare, like vision and hearing coverage.

Comparing Your Choice of Original Medicare with Medicare Advantage

Original Medicare

|

Medicare Advantage (Part C)

|

Understanding Modified Adjusted Gross Income (MAGI)

There is one thing that will have a huge impact on your Medicare costs— your modified adjusted gross income (MAGI). Your MAGI is your adjusted gross income (AGI) minus allowable tax deductions and credits. Once you retire, you may be surprised to find that a combination of income from pensions, investment earnings, traditional (non-Roth) IRA withdrawals, and traditional 401(k) withdrawals may land you with a higher MAGI than you realized. While you may no longer be earning a traditional income from working a job, your MAGI will still reflect all of your taxable income.

RMD Impacts

A required minimum distribution (RMD) is the amount you are required to withdraw annually from specific retirement accounts, such as traditional (non-Roth) 401(k)s and traditional Individual Retirement Accounts (IRAs). Starting at age 73, you must take your first RMD by April 1 of the following year, and each subsequent RMD must be taken by December 31 each year after. These mandatory withdrawals are added to your taxable income, minus any allowable deductions or credits.

Higher Medicare Premiums for High Earners

How does retirement income connect to Medicare premium costs? If you have a high income, you will be subject to an income-related monthly adjustment amount (IRMAA) that must be paid in addition to Medicare Part B and Part D premiums, and it’s calculated every year. If the SSA determines you must pay an IRMAA, you’ll receive a notice with the new premium amount and the reason for it.

For 2025, the standard monthly premium is $185 per person per month. In 2025, single filers with 2023 MAGI of more than $106,000 and married couples filing jointly with 2023 MAGI of over $212,000 will pay more. (See Two-Year Lookback below for why we used 2023 MAGI.)

The Part B IRMAA surcharge amounts per person per month for 2025 range from $74.00 to $443.90, while Part D surcharges range from $13.70 to $85.50 depending on income!

Other Impacts

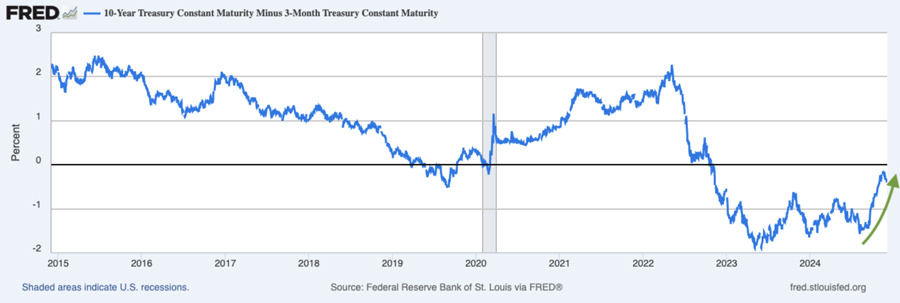

Other income sources can also contribute to an increased MAGI. Capital gains, home sale profits, and even Treasury bill yields contribute to a retiree’s MAGI.

Two-Year Lookback

Now that you know what contributes to your MAGI, know that when you go to enroll in Medicare, your MAGI from your tax return two years prior will determine your premiums. This “two-year lookback” rule can catch retirees off-guard if they receive large distributions or gains, increasing their premiums unexpectedly. This is why it’s a good idea to start preparing for premium costs as soon as possible, and be strategic about it. The last thing you want is to be settling into retirement and then be hit with a high premium if you can avoid it. Be aware that the two-year lookback is ongoing throughout your retirement, and your premiums may go up in any given year if your income goes up two years prior.

Potential Strategies

By now you know that your Medicare premiums are directly influenced by your modified adjusted gross income (MAGI)—the higher your MAGI, the higher your premiums may be. To help manage this, it helps to work with a retirement planner years before filing for Medicare at age 65, and years before you plan to retire so that a specific retirement income plan can be created for you.

Your advisor will work with you to map out your retirement with a strategy that includes which accounts to draw from and/or which taxable accounts you might want to convert to Roth accounts to potentially save money for the long-term. It all works together!

Planning for Medicare can seem like an overwhelming process. From knowing which retirement accounts to leverage to help keep your MAGI as low as possible, to accounting for that two-year lookback, it can be a lot. That’s why the best place to start in your plan is talking to someone knowledgeable about retirement planning.

If you need help getting started in your Medicare planning, we’re here to help! You can reach Bay Trust Financial at 813.820.0069.

Sources:

https://www.medicare.gov/basics/get-started-with-medicare/medicare-basics/parts-of-medicare

https://www.investopedia.com/terms/m/magi.asp

https://www.investopedia.com/terms/r/requiredminimumdistribution.asp

https://www.cms.gov/newsroom/fact-sheets/2025-medicare-parts-b-premiums-and-deductibles

https://www.kiplinger.com/retirement/medicare/what-you-will-pay-for-medicare-in-2025